Welcome to The Tiger’s Prey and the 3rd issue of the Idea Thesaurus!

In this week’s Idea Thesaurus spreadsheet, you’ll find a comprehensive compilation of 282 stock entries. For a detailed breakdown, both in text and as a PNG, please refer to the section below. The file, which you can freely share with your friends and colleagues, is accessible through the following "Download" button:

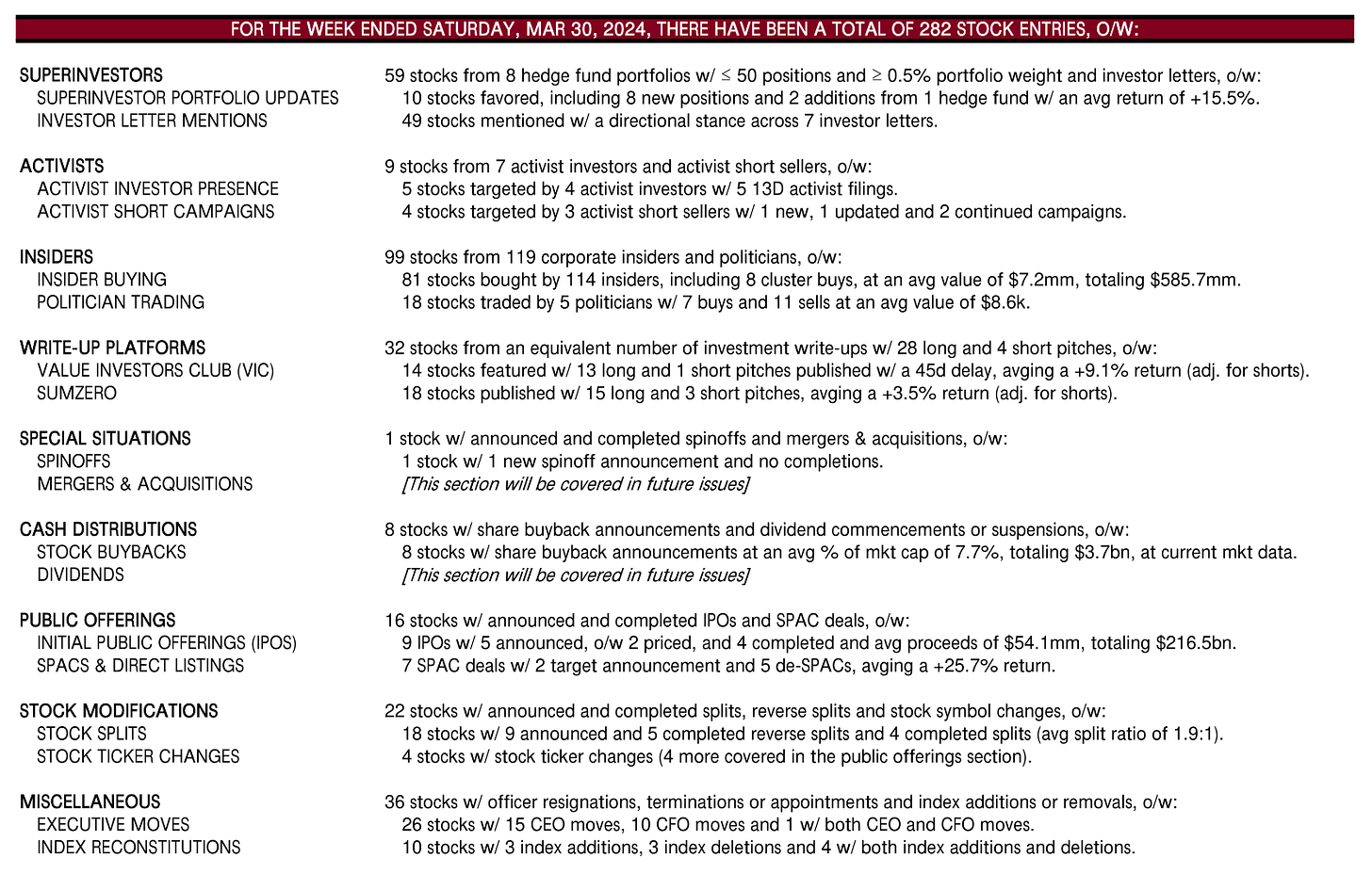

For the week ended Saturday, Mar 30, 2024, there have been a total of 282 stock entries, o/w:

SUPERINVESTORS: 59 stocks from 8 hedge fund portfolios w/ ≤ 50 positions and ≥ 0.5% portfolio weight and investor letters, o/w:

SUPERINVESTOR PORTFOLIO UPDATES: 10 stocks favored, including 8 new positions and 2 additions from 1 hedge fund w/ an avg return of +15.5%.

INVESTOR LETTER MENTIONS: 49 stocks mentioned w/ a directional stance across 7 investor letters.

ACTIVISTS: 9 stocks from 7 activist investors and activist short sellers, o/w:

ACTIVIST HEDGE FUND PRESENCE: 5 stocks targeted by 4 activist investors w/ 5 13D activist filings.

ACTIVIST SHORT CAMPAIGNS: 4 stocks targeted by 3 activist short sellers w/ 1 new, 1 updated and 2 continued campaigns.

INSIDERS: 99 stocks from 119 corporate insiders and politicians, o/w:

INSIDER BUYING: 81 stocks bought by 114 insiders, including 8 cluster buys, at an avg value of $7.2mm, totaling $585.7mm.

POLITICIAN TRADING: 18 stocks traded by 5 politicians w/ 7 buys and 11 sells at an avg value of $8.6k.

WRITE-UP PLATFORMS: 32 stocks from an equivalent number of investment write-ups w/ 28 long and 4 short pitches, o/w:

VALUE INVESTORS CLUB (VIC): 14 stocks featured w/ 13 long and 1 short pitches published w/ a 45d delay, avging a +9.1% return (adj. for shorts).

SUMZERO: 18 stocks published w/ 15 long and 3 short pitches, avging a +3.5% return (adj. for shorts).

SPECIAL SITUATIONS: 1 stock w/ announced and completed spinoffs and mergers & acquisitions, o/w:

SPINOFFS: 1 stock w/ 1 new spinoff announcement and no completions.

MERGERS & ACQUISITIONS: [This section will be covered in future issues]

CASH DISTRIBUTIONS: 8 stocks w/ share buyback announcements and dividend commencements or suspensions, o/w:

STOCK BUYBACKS: 8 stocks w/ share buyback announcements at an avg % of mkt cap of 7.7%, totaling $3.7bn, at current mkt data.

DIVIDENDS: [This section will be covered in future issues]

PUBLIC OFFERINGS: 16 stocks w/ announced and completed IPOs and SPAC deals, o/w:

INITIAL PUBLIC OFFERINGS (IPOS): 9 IPOs w/ 5 announced, o/w 2 priced, and 4 completed and avg proceeds of $54.1mm, totaling $216.5bn.

SPACS & DIRECT LISTINGS: 7 SPAC deals w/ 2 target announcement and 5 de-SPACs, avging a +25.7% return.

STOCK MODIFICATIONS: 22 stocks w/ announced and completed splits, reverse splits and stock symbol changes, o/w:

STOCK SPLITS: 18 stocks w/ 9 announced and 5 completed reverse splits and 4 completed splits (avg split ratio of 1.9:1).

STOCK TICKER CHANGES: 4 stocks w/ stock ticker changes (4 more covered in the public offerings section).

MISCELLANEOUS: 36 stocks w/ officer resignations, terminations or appointments and index additions or removals, o/w:

EXECUTIVE MOVES: 26 stocks w/ 15 CEO moves, 10 CFO moves and 1 w/ both CEO and CFO moves.

INDEX RECONSTITUTIONS: 10 stocks w/ 3 index additions, 3 index deletions and 4 w/ both index additions and deletions.

Happy bargain hunting!